If you ask the average employee what a Compliance Director does, they might imagine a person ticking boxes on a clipboard. But a recent industry survey reveals a different reality: only 20% of compliance teams feel they are "highly proactive."

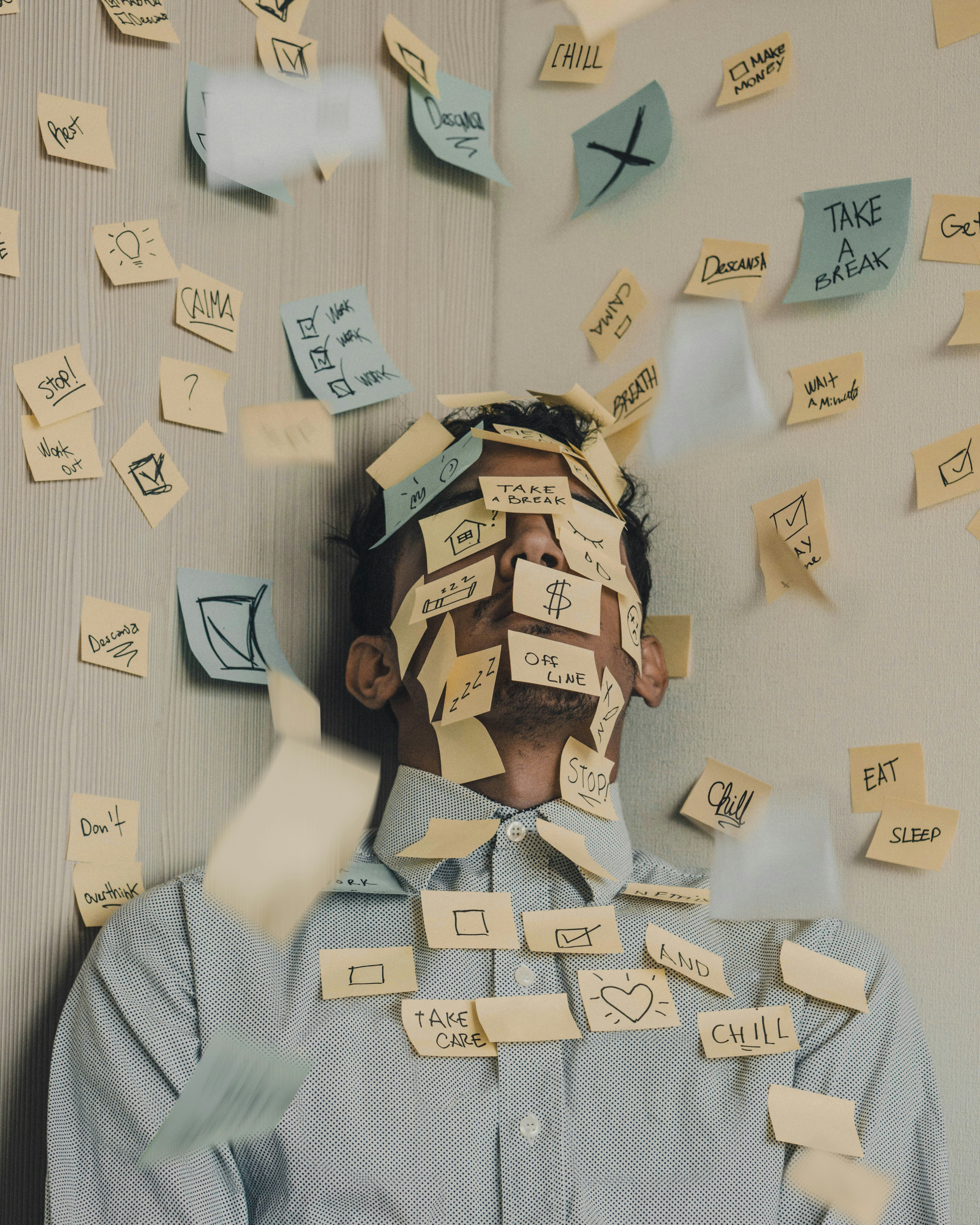

The rest? They are stuck in a cycle of reaction, trying to keep the lights on while navigating an avalanche of new laws.

The bottom line is this wastes money. The Compliance Director at the firm I worked for estimated this to be $100,000 in the previous year.

This role has shifted from operational oversight to high-stakes strategic leadership. Based on recent data from Compliance Week and Barclay Simpson, here are the five specific challenges keeping Compliance Directors up at night in 2025, and how the top 20% are solving them.

1. The "400-Hour" Regulatory Time Sink

Keeping up with the rules is no longer a human-scale task. With the introduction of complex frameworks like the EU AI Act, the volume of reading material is crushing. The Nightmare: A recent survey found that 22% of teams spend more than 400 hours per year just monitoring for changes. That is ten full work weeks lost to reading updates. The Fix: Automate the "Horizon Scanning".

Stop doing it manually: If you are still using spreadsheets to track regulatory updates, you are burning valuable budget.

Leverage AI: Forward-thinking directors are now using AI tools specifically for policy generation (17%) and mapping obligations. Shifting this burden to technology can result in up to a 75% improvement in testing efficiency.

2. The Talent & Wage War

You finally got the budget approval to hire a new Senior Manager, but now you can’t find the human. The Nightmare: According to Barclay Simpson research, less than 1 in 30 compliance managers find candidates to be in "plentiful supply." It is a perfect storm: regulatory pressure is forcing banks and firms to expand teams to demonstrate "conviction," but the talent pool is dry. This has led to aggressive counter-offers and skyrocketing salary expectations that 1 in 4 managers now feel are "excessive." Furthermore, if your sector has suffered reputational damage (like banking post-recession), money alone often isn't enough to attract top-tier talent. The Fix: Retention & "Purpose" Hiring.

Hire for Potential, Train for Skill: You may not find the perfect "unicorn" candidate. Look for transferable skills in legal or audit and train them on the specific regulations.

Sell the "Guardian" Role: If reputational damage is a blocker, flip the script. Pitch the role not as "enforcing rules" for a tainted industry, but as being the "architect of integrity" who ensures the mistakes of the past aren't repeated.

3. The Privacy Pressure Cooker

For years, Anti-Money Laundering (AML) was the headline fear. But the landscape has shifted. The Nightmare: While AML remains critical, 78% of compliance leaders across all industries now list handling privacy concerns as their number one worry—far higher than financial reporting. The Fix: Integrate with InfoSec.

The Collaboration Mandate: Privacy is no longer just a legal issue; it is a tech issue. Survey data shows that 65% of leaders intend to collaborate more closely with Information Security teams.

Joint Task Forces: Don't just meet when there is a breach. Establish a standing weekly sync with your CISO to align on data governance before products launch.

4. The Collaboration Void

You draft the policies, but do the employees follow them? A major source of stress is the disconnect between the Compliance department and the rest of the business. The Nightmare: It is not surprising that improving cross-team collaboration was cited as the #1 strategic priority (by 54% of leaders) for the coming year. If Sales views you as the "Department of No," they will bypass you, creating shadow risk. The Fix: The "Champion" Model.

Deputize the Business: You can't be in every room. Identify "Compliance Champions" within high-risk departments (Sales, Product, HR).

Embed, Don't Impose: Train these champions to spot red flags early so they can self-correct workflows before a violation ever reaches your desk.

5. The "Access to Data" Struggle

You can't report on what you can't see. The Nightmare: 17% of leaders cited "accessing and integrating internal data" as a top challenge. With data scattered across Slack, Email, and various SaaS platforms, getting a single view of your risk posture is often impossible. The Fix: Centralized GRC Platforms.

Streamline Reporting: 40% of directors are prioritizing streamlined reporting this year.

Single Source of Truth: Moving to a centralized Governance, Risk, and Compliance (GRC) platform allows you to pull real-time data, reducing the time it takes to produce a board report from weeks to days.

Conclusion: Moving the Needle

The transition from "Reactive" to "Proactive" isn't easy, especially when talent is scarce and regulations are multiplying.

The data suggests that the Directors who will sleep best in 2025 are those who stop trying to solve every problem with more headcount (which they can't find) and start solving them with better technology, smarter collaboration, and automated efficiency.

Data from https://www.pwc.co.uk/industries/financial-services/insights/understanding-true-costs-of-compliance.html clarifies that regulatory compliance costs for UK financial services firms have exceeded £33.9 billion annually. So it's important to put time and effort into compliance systems and the more automation the better.